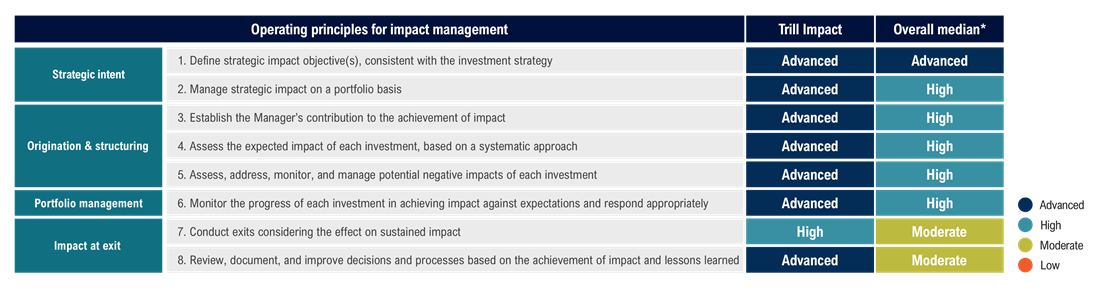

Trill Impact’s alignment with the Operating Principles for Impact Management has been independently verified

Trill Impact AB has been a signatory of the Impact Principles since February 2020. The Impact Principles are a framework for the design and implementation of impact management systems, with a goal to ensure that impact considerations are integrated throughout the investment lifecycle. Signatories to the Impact Principles are impact investors and advisors who publicly demonstrate their commitment to implementing a global standard for managing investments for impact.

As per Principle 9, Trill Impact has published its annual Disclosure Statement and engaged BlueMark, a Tideline company, to independently verify the alignment of its impact management practices with the Operating Principles for Impact Management. BlueMark’s assessment findings cover both areas of strength and areas for improvement, as reflected in the Verifier Statement.

Trill Impact received the highest possible result given that the fund has not had any exits to date. Trill Impact results are also considerably better than the median result based on 30 verifications done by BlueMark (see Making the Mark 2021 report for more details).

*The median result is based on 30 verifications done by BlueMark (see Making the Mark 2021 report for more details)

*The median result is based on 30 verifications done by BlueMark (see Making the Mark 2021 report for more details)

The verification by BlueMark was done for the buyout fund. Microfinance fund partner Developing World Markets is a signatory of the Principles and have completed a third-party verification.

| Trill Impact's Disclosure Statement February 2021 | BlueMark's independent Verification Statement |

| Trill Impact's Disclosure Statement February 2022 |

BlueMark is a leading independent provider of impact verification services in the impact investing market. BlueMark is a subsidiary of Tideline Advisors, LLC, a specialized consulting firm that works with asset managers and allocators to design and implement best in class impact management and measurement systems.

Related links