Annual Impact Review 2024

Annual Impact Review 2024

Why Trill Impact?

Our ambition - build responsible impact leaders

Within Buyout and Ventures, we strive to create measurable environmental and social impact alongside competitive financial returns – through our portfolio companies.

- Would your business benefit from venture financing or expansion capital and a network of experienced professionals?

- Are you ready to embark on a journey to accelerate profitable growth and create value by leveraging your full impact potential?

- Are you interested in becoming part of our Impact House?

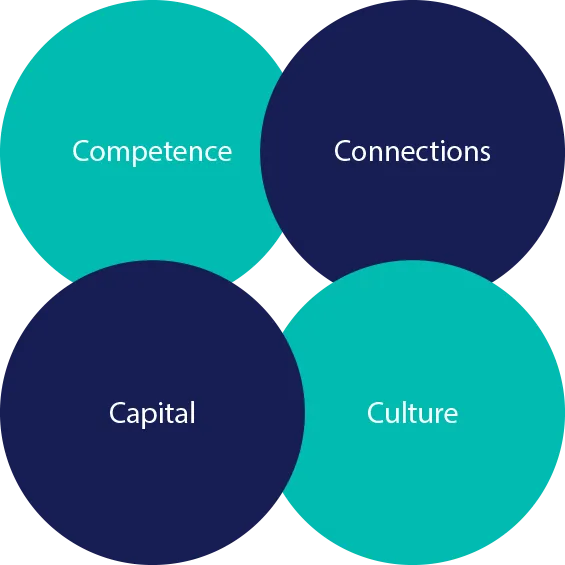

What we bring to the table

Within Buyout and Ventures, Trill Impact invests in promising companies. Our intention is to support them in amplifying their positive impact on the planet and society. A portfolio company that is part of our Impact House, will have access to the relevant competence, connections and capital, supported by Trill Impact’s recognized impact culture – heart and mind combined.

Within Microfinance, Trill Impact has a specifically tailored approach to impact and value creation.

Commercial benefits of being part of our Impact House

We are here to serve as an active advisory partner throughout the development journey, working closely with the portfolio companies’ management teams and boards to transform and grow the business. Through our collaborative and value-based approach, our highly experienced team, our professional network and proprietary toolbox, we aim to contribute to sustainable commercial improvements in the following areas:

Sales and profitability

Increased volumes and pricing, based on improved customer loyalty, as sustainable product and service offerings resonate with customer sentiments.

Mergers & acquisitions

Increased attractiveness for M&A discussions with company owners. Simplified integration of new companies due to impact branding.

Recruiting talent

More attractive as an employer as many talent considers sustainability as key. Also helping family run businesses to hire management teams externally.

Valuation

Opportunity for higher financial market value based on a strong sustainability profile.

Financing terms

Access to wider and commercially more attractive financing options, based on proven ESG and impact performance.

Impact culture

Accelerated impact and ESG implementation through Trill Impact’s support and through our proprietary Impact Champion Program.

We will make the journey together

Our ambition is to build successful businesses and drive positive change, in cooperation with Trill Impact’s portfolio companies.

As an active and close partner to the portfolio company's management, we will embark on a journey to accelerate profitable growth and support each company to reach its full impact and value creation potential.

We are excited by a shared vision to contribute our best to the business we partner with, every single day.

Jointly, we will introduce measures to:

- Align commercial and impact vision and goals and set clear priorities to accelerate value-creating impact.

- Define targets and implement tools for successful execution related to climate and environmental practices, diversity and good governance (ESG).

- Introduce incentive structures, with combined financial, impact and ESG targets.

- Provide access to attractive financing options, when relevant tied to impact and ESG targets.

What is it like to be a Trill Impact portfolio company?

Toke Kjær Juul, CEO of Nordomatic

Our collaboration with Trill Impact has been transformational, providing more than just financial investment. The partnership resonates with our core values, particularly in advancing sustainability and innovation. We consider Trill Impact's support as instrumental in scaling our solutions, broadening our market reach, and intensifying our impact on environmental sustainability.

Through our partnership with Trill Impact, we were able to establish impact targets and start measuring our impact. For 2024, we aim to enable our customers to increase their CO2e reduction from 192,000 tons to 225,000 tons, and Trill Impact will be a vital partner in achieving this goal.

Frida Westerberg, CEO of Allurity

Cybercrime is one of the biggest threats to society today. Our mission is to enable a safe digital world and we have embarked on a growth journey with the vision to become the preferred partner of tech-enabled cybersecurity services in Europe. Trill Impact is a great owner on that journey with a constructive and collaborative approach. They provide valuable support in a wide range of areas such as M&A, strategy and branding as well as deep insights into impact and ESG.

Eola Änggård Runsten, Board Member of ILT Education

I appreciate that Trill Impact is an impact firm, exclusively investing in companies that contribute to a better society. ILT Education qualifies well into the category – focusing on audio and visual-assisted learning solutions for students with dyslexia, other cognitive needs, and multilingual backgrounds.

Christer Ahlberg, CEO of Cinclus Pharma

Trill Impact Ventures has enabled us to formulate and focus our interest for impact and ESG topics into a clear, value creating strategy for improved quality of life for people worldwide living with gastric acid related diseases underpinned by our superior P-CAB, linaprazan glurate.